Yahoo’s Evolution

The Yahoo of today is the result of numerous corporate acquisitions, migrations and consolidations over the past several decades. Its rapid growth, peak, decline and current rebirth created feature redundancy, framework latency and inconsistent user experience throughout the ad tech platforms. Take a look at Yahoo’s strategy for solving this issue.

THE HISTORY

The Early Years: In 1995, the company incorporated and launched Yahoo as a web portal, offering search, email, news, and other services. Yahoo grew rapidly, went public in 1996, and expanded globally.

Growth & Maturity: In the early 2000’s, Yahoo faced increased competition from Google. During this period, Yahoo made several strategic mistakes, such as failing to acquire Google and Facebook. Yahoo also made significant acquisitions.

The Verizon Era: In 2017, Yahoo was acquired by Verizon and merged with AOL to create a new company called Oath. The integration was difficult, and the company struggled to compete in digital advertising. In 2019, Oath was rebranded as Verizon Media Group.

Today: In 2021, Verizon sold Verizon Media Group to Apollo Global Management for $5 billion, and the company was rebranded as Yahoo again.

THE PRODUCT DESIGN CHALLENGE

Due to the continual evolution of the company and the numerous corporate acquisitions that took place over nearly 30 years, the B2B platforms and back-end systems supporting the ad tech business were struggling to keep pace with the outward B2C brand. Logo and color updates were simple compared to pairing disparate tech frameworks and dealing with redundant mediation layers.

As a result, the main business focus was on engineering integrity to keep the revenue flowing. The user experience wained and was given less priority. This trend became the norm rather than the exception and permeated the culture of Product and Engineering.

UX COMPONENTS

Partially due to the size of the company, work teams became siloed and focused on particular platforms alone. The User Experience team was uniquely positioned to see the overall scope of the problem because we worked on all of the platforms. It was necessary to shine a light on the UX pain points and make the business case for consolidation.

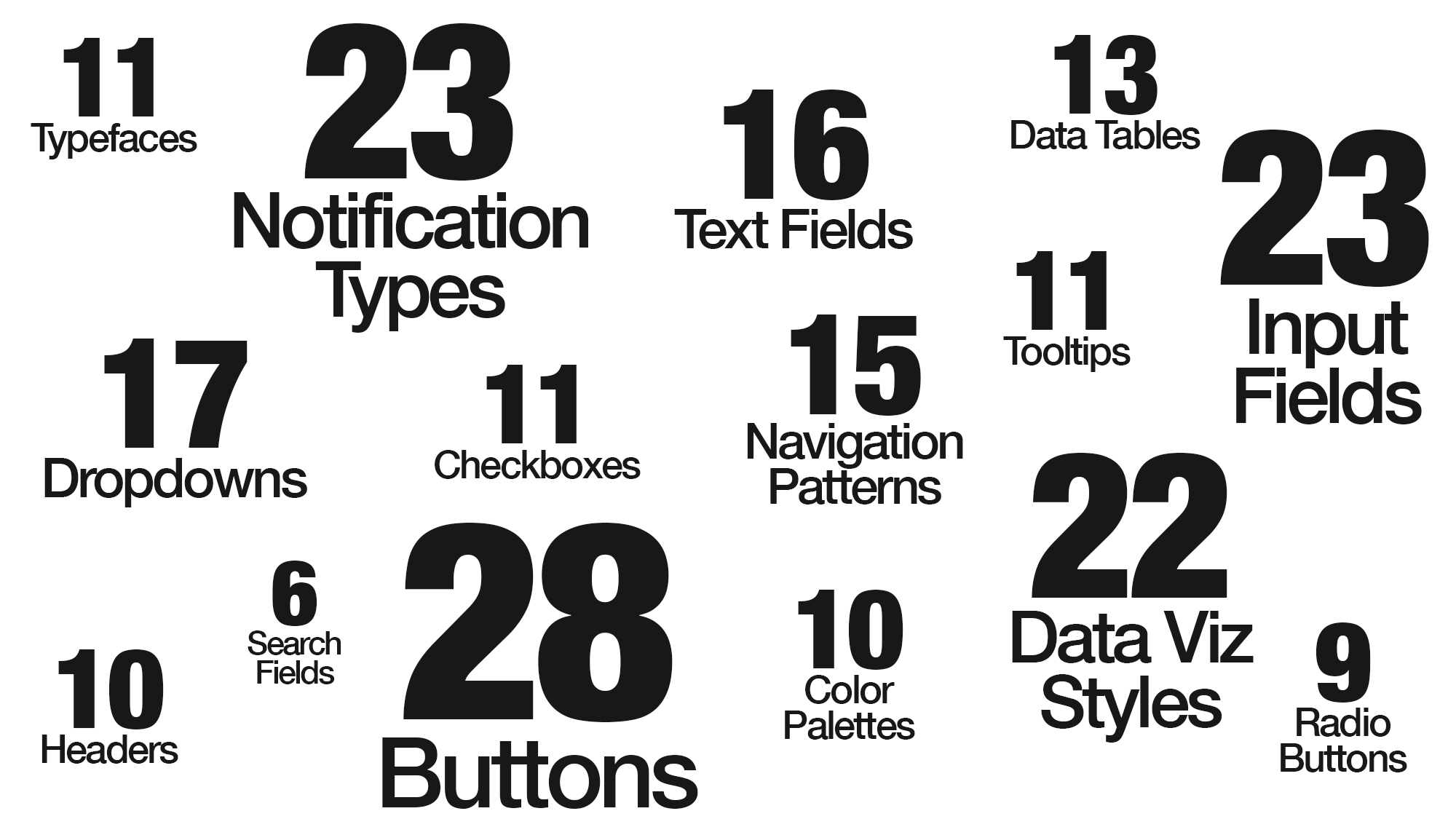

An audit of all Ad Platform products was conducted which uncovered a large variety of patterns & component styles. Our initial approach was to highlight the potentially negative brand impact this type of disorganization could cause. This message did not resonate with business leaders who were focused on backend migration and client revenue goals. Aesthetics were considered secondary at best.

A new approach was needed.

DESIGN SYSTEM

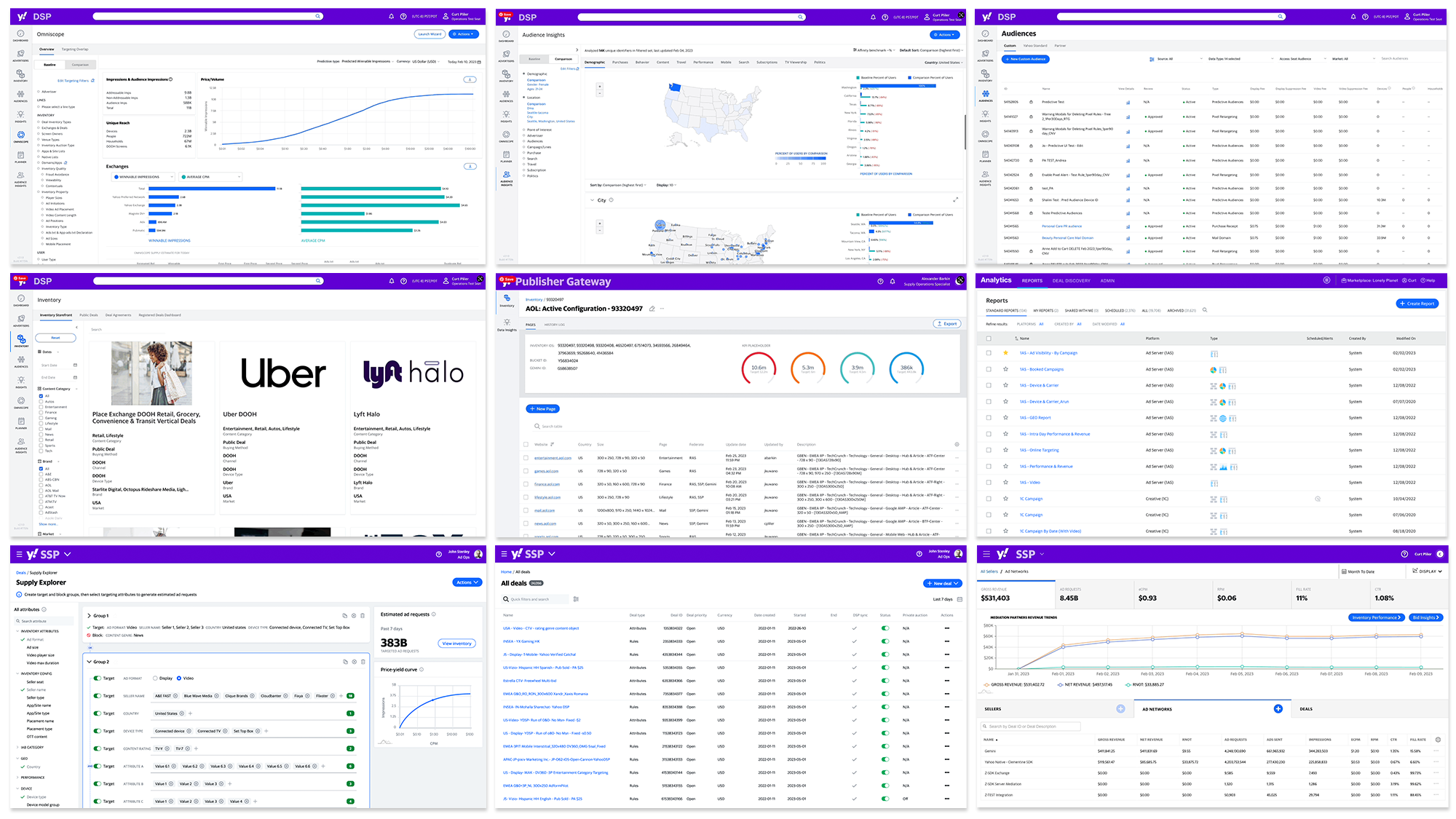

While a new consolidation approach was developed, the User Experience team got to work on a new Atomic component design system. All designers moved to Figma and a design library was built to increase efficiency within the design org. As new product features were released, The UX team collaborated with Product and Engineering to adopt the new design patterns and components to slowly build brand consistency across the various ad platforms being used.

In conjunction with this effort, numerous UXR studies were conducted to test the design system patterns and arrive at page layouts and feature workflows that could be shared across all platforms.

ENGINEERING COLLABORATION

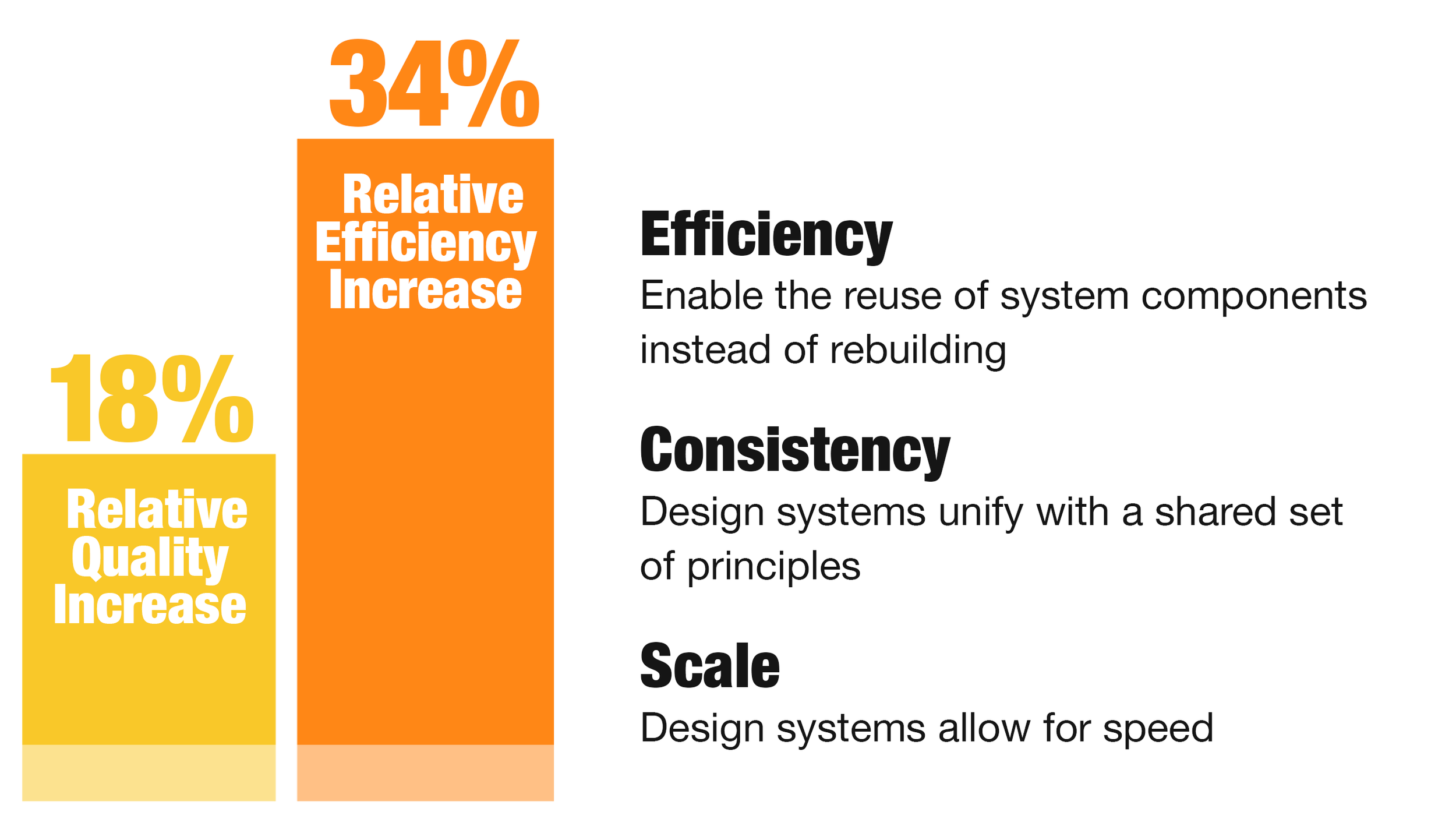

During this same period, the Engineering teams were reorganized and brought under a centralized leadership with a front-end team that began working closely with the User Experience group. This new centralized team was now able to see the disparity between platforms with a new lens and became frustrated with the inefficiencies uncovered as they witnessed their developers rebuilding the same components over and over again.

Together with our new allies in engineering, we were able to approach the UX disparity in terms of developer resources, which were always scarce. While disparate back-end frameworks continued to be an obstacle to overcome, framework-agnostic components began to be adopted by engineering and deployed across the platform ecosystem.

RESULTS

While this is very much an ongoing resolution, a clear vision has been established and strong cross-platform / cross-discipline relationships have been firmly established. All new features are mandated to use the new design system. Engineers are no longer allowed to build new patterns and components without strong business justification. Communication between teams has been enhanced and leadership from all orgs are in agreement about the direction the platforms are heading in.

Customer satisfaction surveys are planned for mid year and end of year and a consulting firm has just concluded a multi-quarter benchmark study do determine a current state of metrics for the DSP, SSP, Analytics and Flurry platforms.